It broke in the exact same way as the key diagonal, and thus went . The left upper side and the ideal bottom side look like their symmetry.Originally Posted by ;

|

|

It broke in the exact same way as the key diagonal, and thus went . The left upper side and the ideal bottom side look like their symmetry.Originally Posted by ;

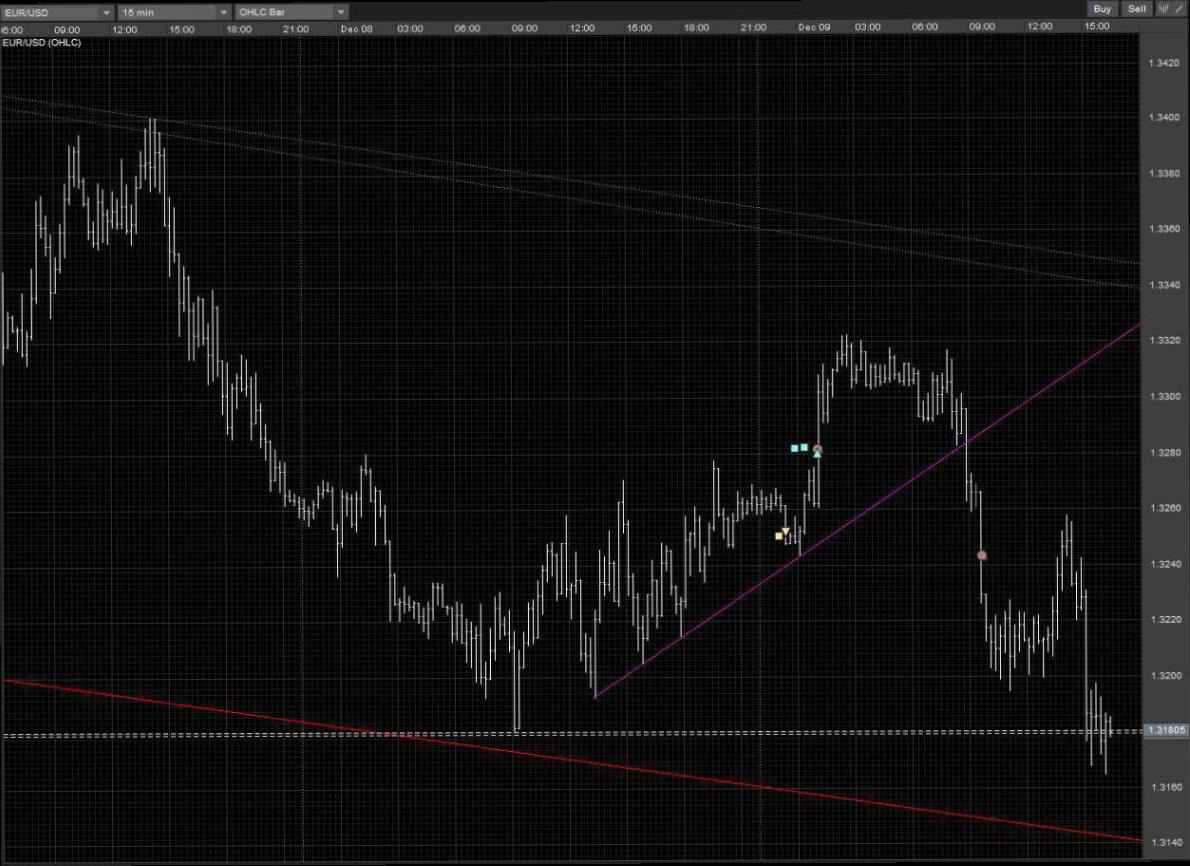

A break happened while I was sleeping, and also to place a stop below the false break after the price moved back on the TL, a 60 pip stop would've been required. Even though that seems excess, it is just about 30% of 44ADR. Now, let us see if it fills the divergence.Originally Posted by ;

Because the day's range was just 55 percent of 44ADR (42 pips), I opt to let the trade run for a longer time period, and I am moving the stop to nearly BE. It's a free run today.Originally Posted by ;

Got greedy and was penalized accordingly. In fact, it looks like that there was an 18.3 in the opposite direction, giving me a clue to close and reverse, but the timing was a bit early for the template, and I wasn't in the PC in the time.Originally Posted by ;

Next target: NZD/USD trendline break buy. A level for stops was offered, so I took it. TP based on ADR, in this circumstance it is roughly 80 pips or 80 percent of 44ADR. Now the price seems to be spinning around, so I'm putting a reverse order, using a stop above the current sessions . Trade is against the MMOW, but with the MMOM.

Due to Mr. C for pointing out the comb on EUR/USD. Because my platform only has H3, and no H4, the comb looks a bit different. You can see the order on the chart, the end is above the high of yesterday.

Sell stopped out, and reverse stopped out. Using H3 did not pay this moment off.Originally Posted by ;

USDCHF market order. Stop over the session's high. Sell order under yesterday's low. Trade will be contrary to the MMOW but with the MMOM. The top and bottom borders aren't parallel, however, the creation is slightly narrowing. I could buy right now using a stop under yesterday's low, but I am unsure of this, so I opt to trade the break rather.

Hey Mizuno,

Where are you fellow? Anyway, hope you have a fantastic vaion period, and that I hope to see you back here soon, your charts are looking good, so keep up the hard work, let's all grab a few more pips in 2011.

Peace out

Hey Niteshift! I'm here, just lurking around. It is only one of the times when you drop back and reflect in your own life, look at you are and what you have to do. I get those once in a while. I'm back next week. I wish you happy holidays, and a 2011. Let's seize the day, regularOriginally Posted by ;

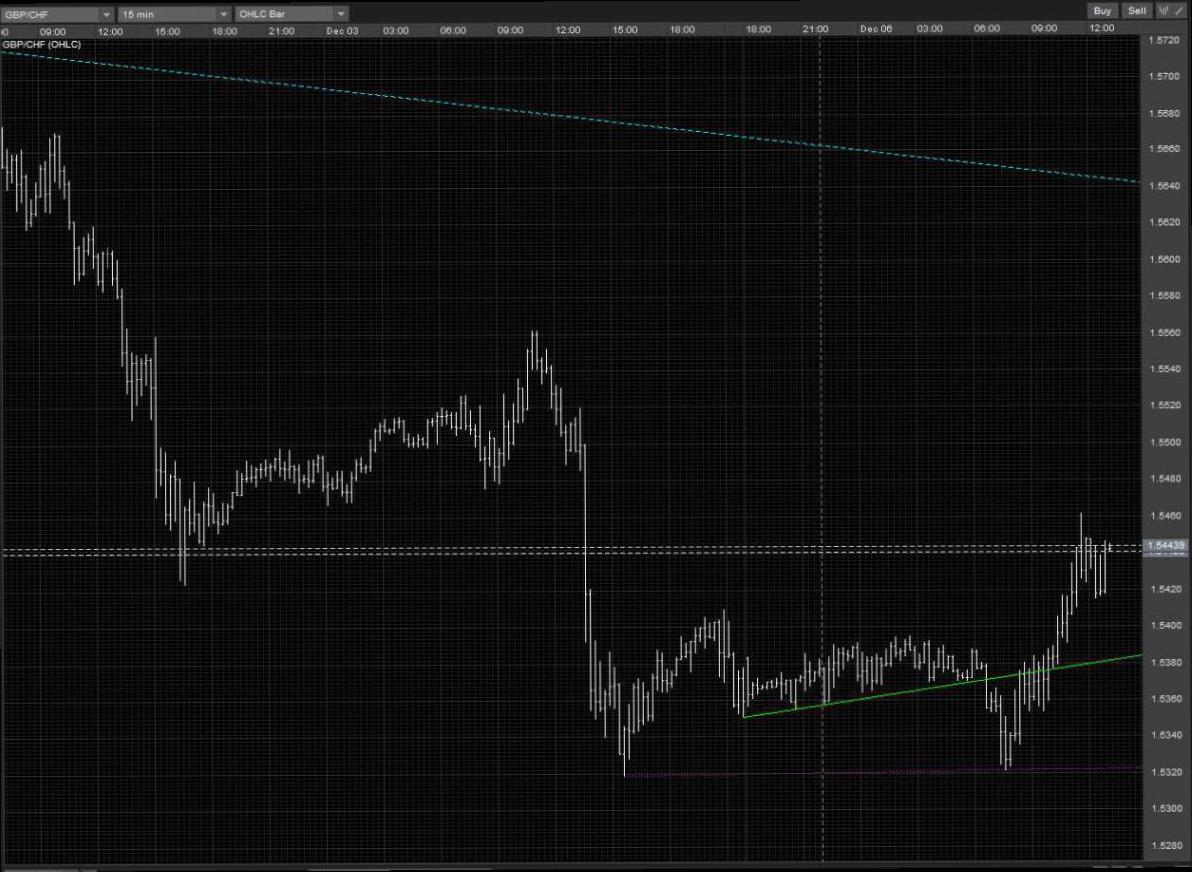

Here is a setup I'm not taking. A wedge with fully shaped upper border, providing an opportunity to buy on the 3rd method of the bottom border. However, there's a divergence against this notion, that's why I'm only watching this. It probably might be worth it to skip the buy and sell the break of the bottom border, as though you were reversing the buy trade, but I do not see a reputable high formed nonetheless.

Both green dotted borders are all parallel.